Out Of Scope Gst Malaysia

Gst is also charged on the importation of goods and services.

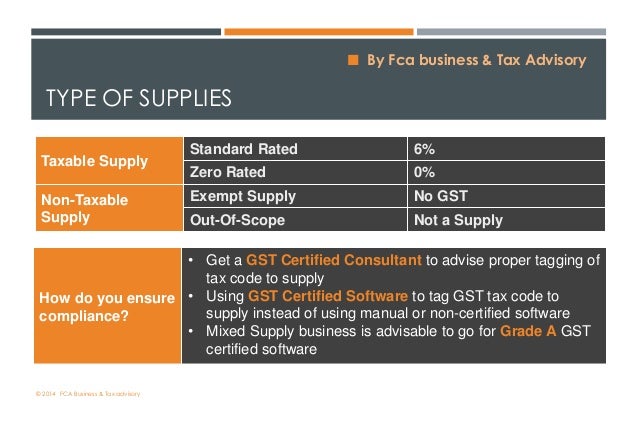

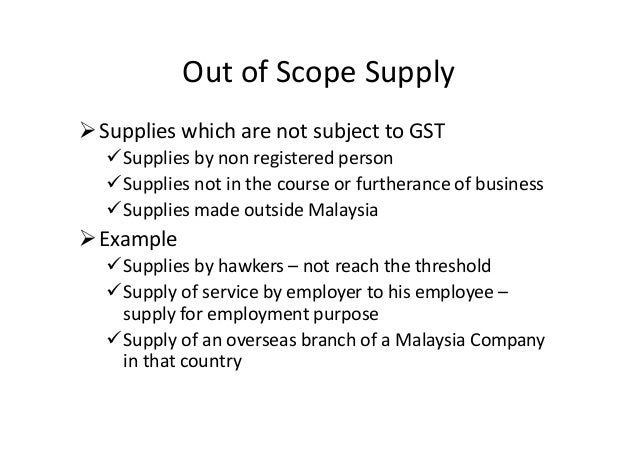

Out of scope gst malaysia. Gst concepts and principles 3 scope of gst the scope of gst is provided for under section 7 of the gst act. Goods and services tax gst is a broad based consumption tax levied on the import of goods and services as well as nearly all supplies of goods and services in malaysia except for zero rated exempt supplies. Exempt and out of scope supplies are not taxable supplies.

A tax to be known as goods and services tax shall be charged and levied on any supply of goods or services made in malaysia including anything treated as a supply under this act. 1 the supply of goods and services in singapore and 2 the importation of goods into singapore. Examples of such supply are.

A taxable supply is a supply which is standard rated or zero rated. Charge gst at 0 only if it falls within the description of international services under section 21 3 of the gst act. B it is a taxable supply of goods or services.

You can zero rate your supply of services i e. Below is a brief conceptual overview of two proposed taxes. Therefore gst is charged when.

And d it is made in the course or furtherance of any business carried on by that taxable person. Any importation of goods into malaysia. Section 9 of gst bill 2014.

Exempt and out of scope supplies are not taxable supplies. Gst is also charged on the importation of goods and services. Any supply will be outside the scope of gst if it does not comply with all the above conditions.

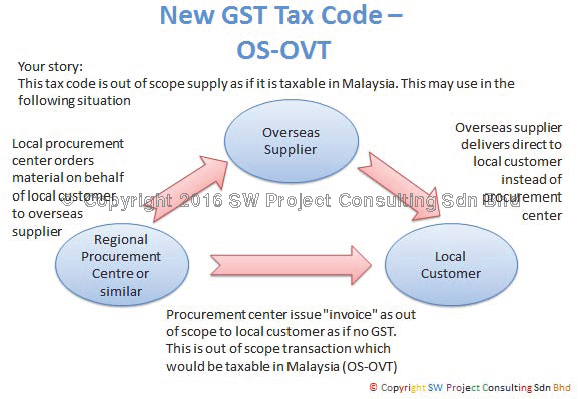

The proposed taxes are conceptually a re introduction of the sales tax and service tax that existed prior to the introduction of gst but with some changes in its scope and also its administrative and compliance aspects. The sale of goods is an out of scope supply and the supply is not subject to gst. It may seem to look like a simple question but it is far from simple.

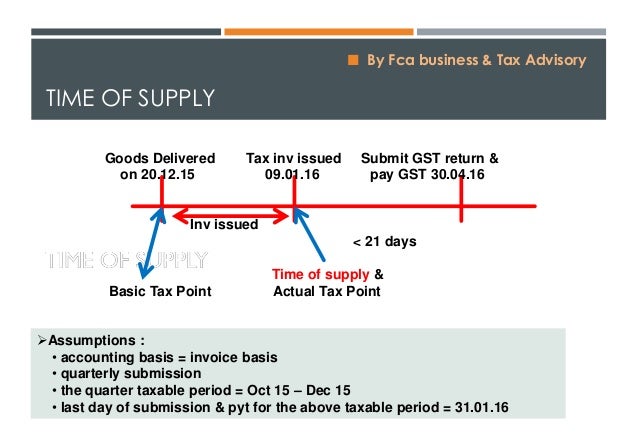

When the goods are subsequently removed from the ftz by company b gst may be chargeable. 2 4 to calculate the gst to be paid to or refunded from the comptroller of gst. The malaysian gst model.

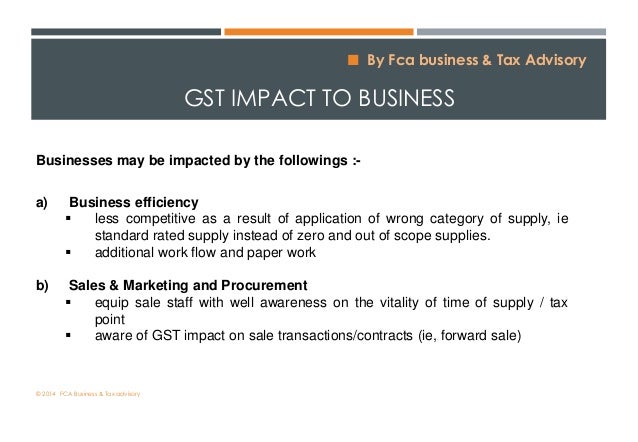

In some countries gst is known as the value added tax vat. In this post it will be about the scope and coverage of gst in malaysia. Gst shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in malaysia by a taxable person.

Gst shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in malaysia by a taxable person. It is important to note that not all services provided to overseas customers can be zero rated. C it is made by a taxable person.

Gst is imposed on. A it is made in malaysia. Find out more information about international services in this extract of section 21 of the gst act pdf 203kb.