Pcb Late Payment Penalty Malaysia

Menyimpan maklumat pekerja dan bayaran pcb cp38.

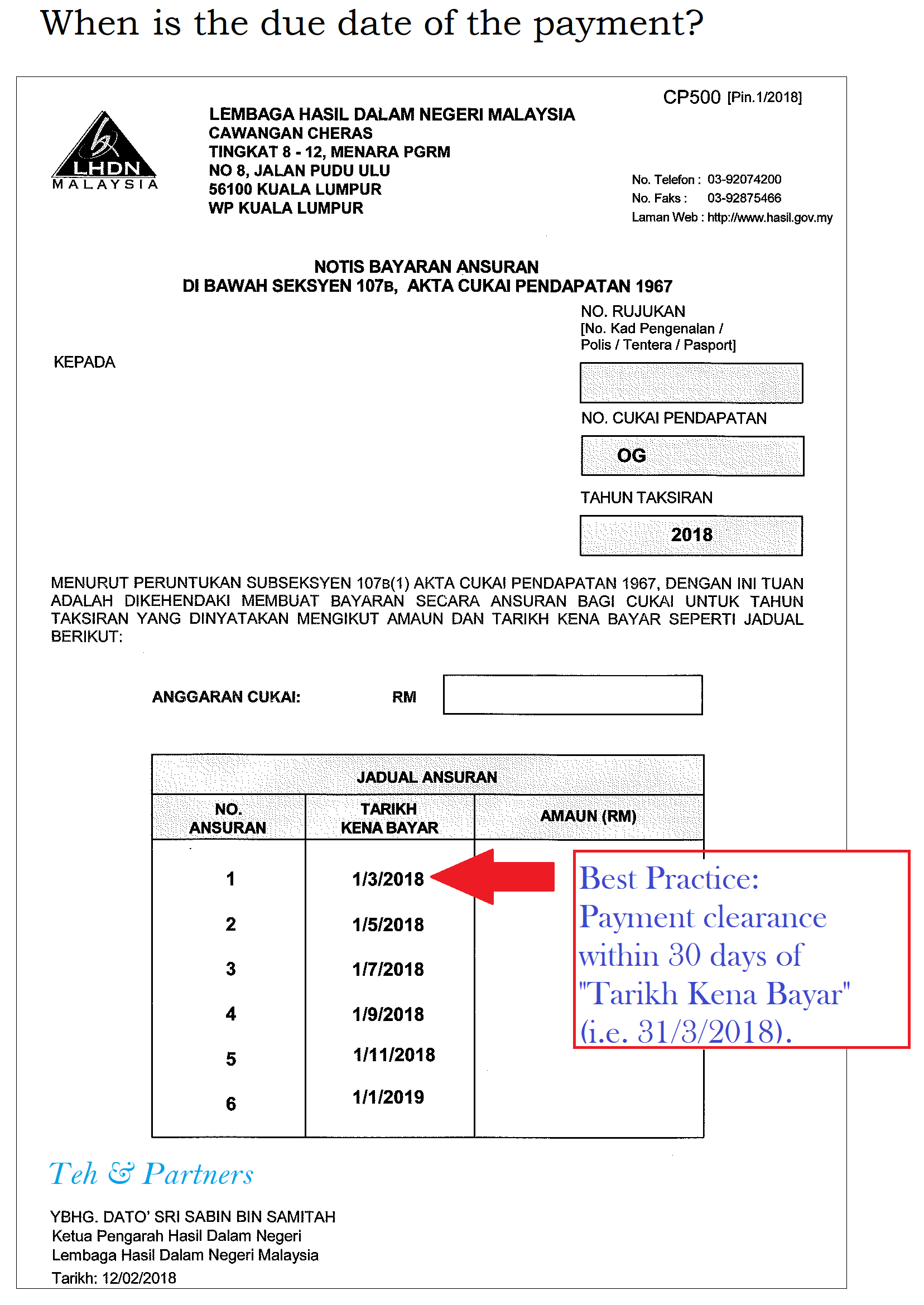

Pcb late payment penalty malaysia. Penalty for late payment a late payment penalty of 10 will be imposed on the balance of tax not paid after 30th april following the year of assessment. Sistem e pcb disediakan untuk kegunaan majikan yang tidak mempunyai sistem penggajian berkomputer untuk. Mtd pcb contribution payment deadline.

An employer who does not deduct mtd or deducts but fails to remit the mtd to irbm can be prosecuted in a civil court. If you as an employer failed to remit payment on or before the 15th of the following month you can be fined. The inland revenue board of malaysia offers several mediums of payment for employers to pay the.

For individual with employment no business income the dateline is 30th april while individual with business income the dateline is 30th june. Both the irb and rmc are encouraging payments through online mode. Tax payment can also be made at any cimb bank public bank maybank affin bank bank rakyat bank simpanan nasional and pos malaysia counters throughout malaysia.

Please use the cp 207 payment slip as a guide to fill up irbm s bank in slip provided at the bank to make payment. There will be no late tax payment increase for payments made within the extended time. Payment of tax by labuan entities.

The following table is the summary of the offences fines penalties for each offence. Furthermore a late payment penalty of 10 will be imposed on the balance of tax not paid after 30th april following the year of assessment. Penalty as per income tax act ita 1967 any person who committed for an offence will be fine either through penalty of imprisonment or both depending on severity or the number of offences.

Mengira pcb pada setiap bulan. Payment can only be made manually through electronic medium together with form 39 or. Penalty will be imposed for any payment made after the due date.

Fine for late payment contribution. 15th of the following month sources from lhdn fine for late payment contribution. The minimum fine is rm200 and not more than rm20 000 or 6 months imprisonment or both.

Interest on late payment of contributions will be imposed at a rate of 6 per annum for each day of contributions not paid within the stipulated period. As per income tax act ita 1967 payment of income tax income tax has to be settle by the due date. Penalty for late.

All payments due to the rmc on march 30 2020 are extended to april 30 2020 and penalty remission will be given for payments during this period. An employer who fails.