Pcb Payment Due Date 2020

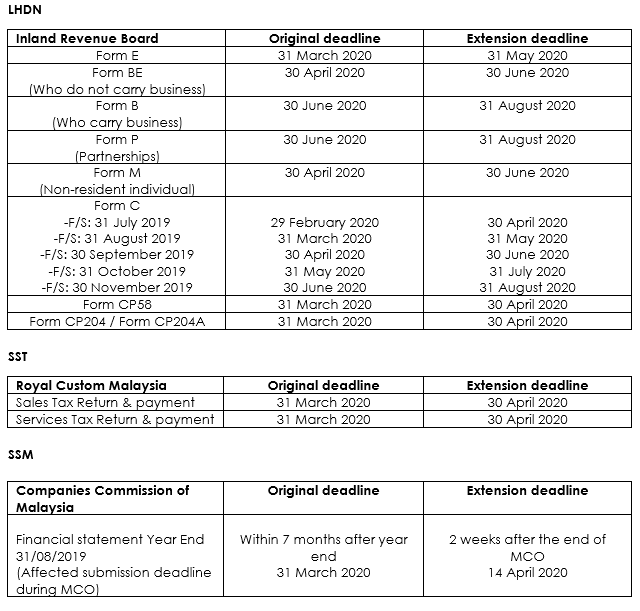

For company entities that is sme paid up capital less than rm2 5m and revenue less than rm50m are allowable to defer the cp204 payment due on 15 04 2020 15 05 2020 and 15 06 2020 and for other company cp500 payment due on 31 03 2020 and 31 05 2020.

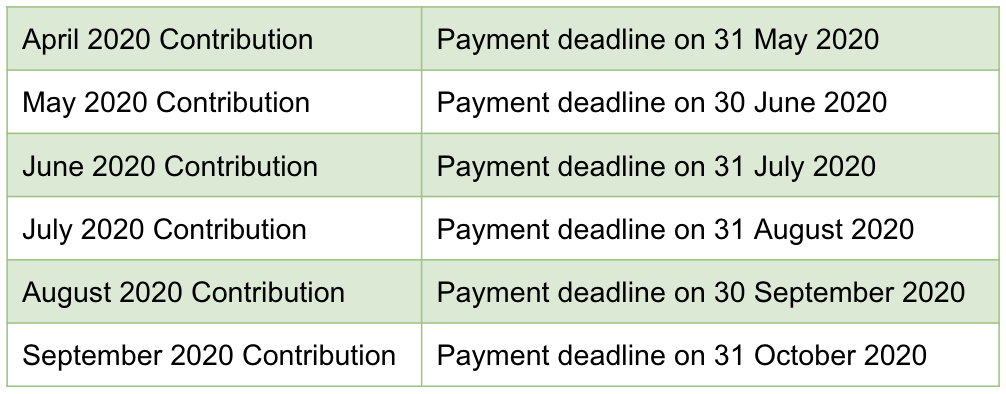

Pcb payment due date 2020. D payment via tele banking. In light of the extension of the conditional movement control order cmco and its subsequent impact on business activities in the country the employees provident fund epf is extending the date for employers to remit their mandatory contribution for the months of may 2020 until july 2020 from the 15th to the 30th of each month respectively. 15th of the following month sources from hrdf hrd levy is to be made no later than the 15th date of the month in which the payment falls due as stated under regulation 8 1 of the pembangunan sumber manusia berhad registration of employers and payment of levy regulations 2001.

Contribution payment deadline. March 31 is the last date for filing belated or revised return of income for. March 15 is the due date for payment of the fourth and last installment of advance tax for the year 2020 21.

The due date for submission of the completed borang 1 new project extension project which ends on 30 april 2020. Cp204 fye april 2021 cp204a 6 fye sep 2020 cp204 9 fye june 2020 corporate tax estimate return. The due date for submission of the completed borang 1 new project extension project which ends on 31 march 2020.

The fine is a minimum of rm 200 and not more than rm 2 000 or 6 months imprisonment or both. Extension of time will be given until 30 june 2020. Kuala lumpur 13 may 2020.

Cp204 fye may 2021 cp204a 6 fye oct 2020 cp204 9 fye jul 2020 corporate tax estimate return. An employer who fails to remit payment on or before the 15th of the following month if the 15th is a holiday the deadline will be the last working day before the 15th can be fined and or imprisoned. Hrdf exemption payment effective from april 2020 to september 2020.

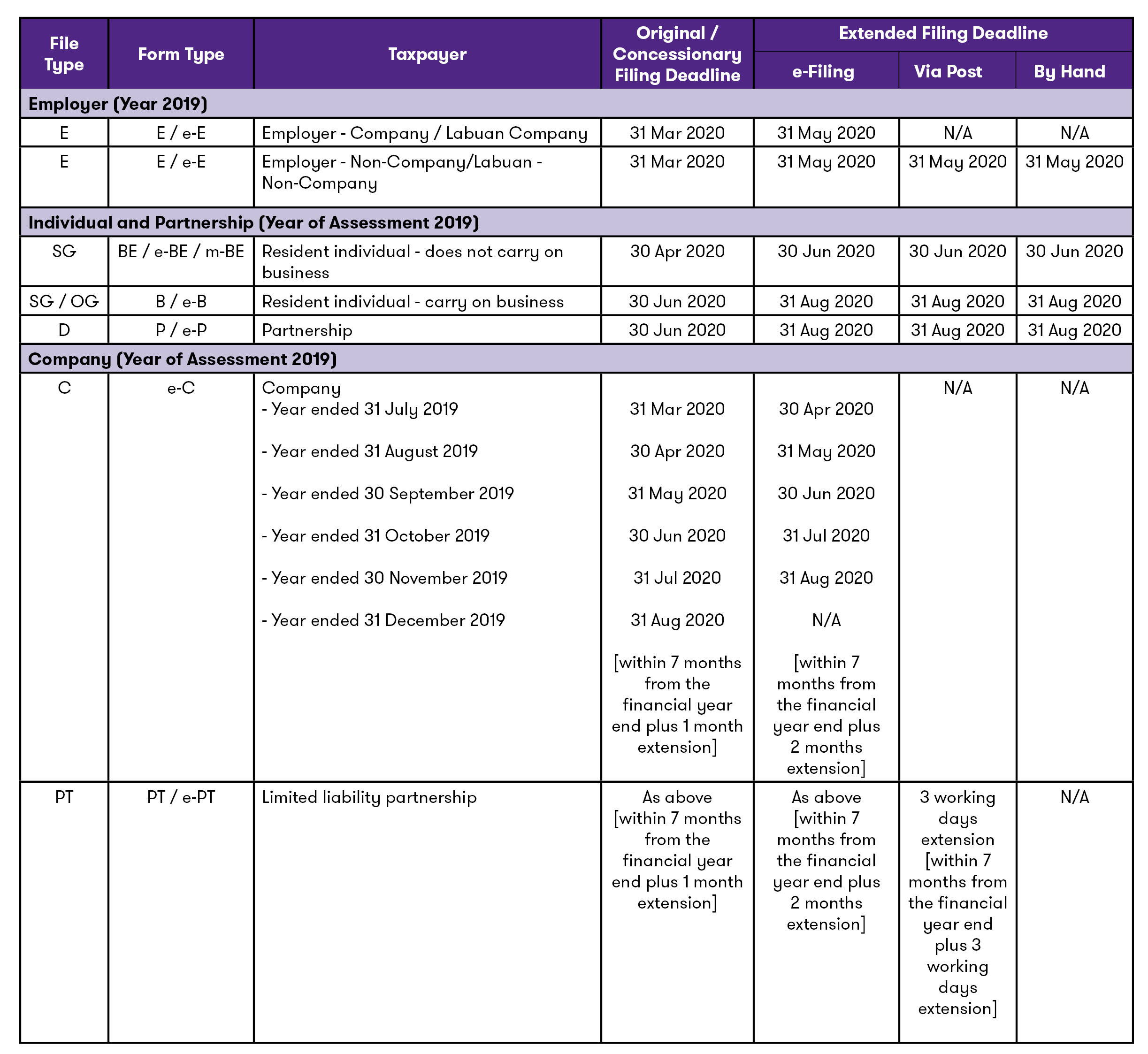

Extension of time will be given until 30 june 2020. Due date for submission. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing.

Pcb monthly tax deduction mtd cp38 payment for march 2020 remuneration. Return form rf filing programme for the year 2020 amendment 1 2020 lhdn faq extension time. 30 april 2020 submission 15 may 2020.

Meanwhile for the b form resident individuals who carry on business the deadline is 15 july for e filing and 30 june for manual filing. Payment of individual income tax and real property gain tax rpgt can be made via tele banking service at bank agent as follow.