Public Mutual Bond Fund

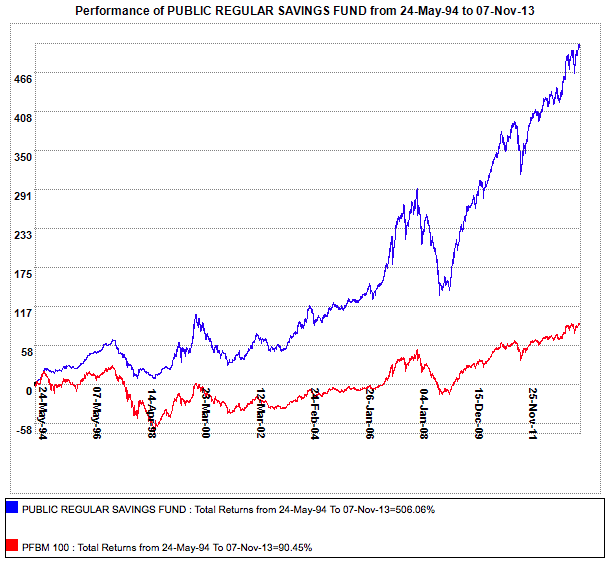

Public mutual berhad a wholly owned subsidiary of public bank is a top private unit trust management company and leading prs provider in malaysia.

Public mutual bond fund. Bond mutual funds are just like stock mutual funds in that you put your money into a pool with other investors and a professional invests that pool of money according to what he or she thinks the best opportunities are. About public mutual public institutional bond fund public institutional bond fund is an open end unit trust established in malaysia. Public mutual online is an online facility that provides online transactions account enquiries as such you may be exposed to the risks associated with hardware software failure.

We offer a comprehensive range of products comprising conventional and shariah based unit trust and prs funds as well as financial planning services. The fund s objective is to provide a steady stream of income. You are also aware and acknowledge the risks involved when you make any transaction or enquiry online.

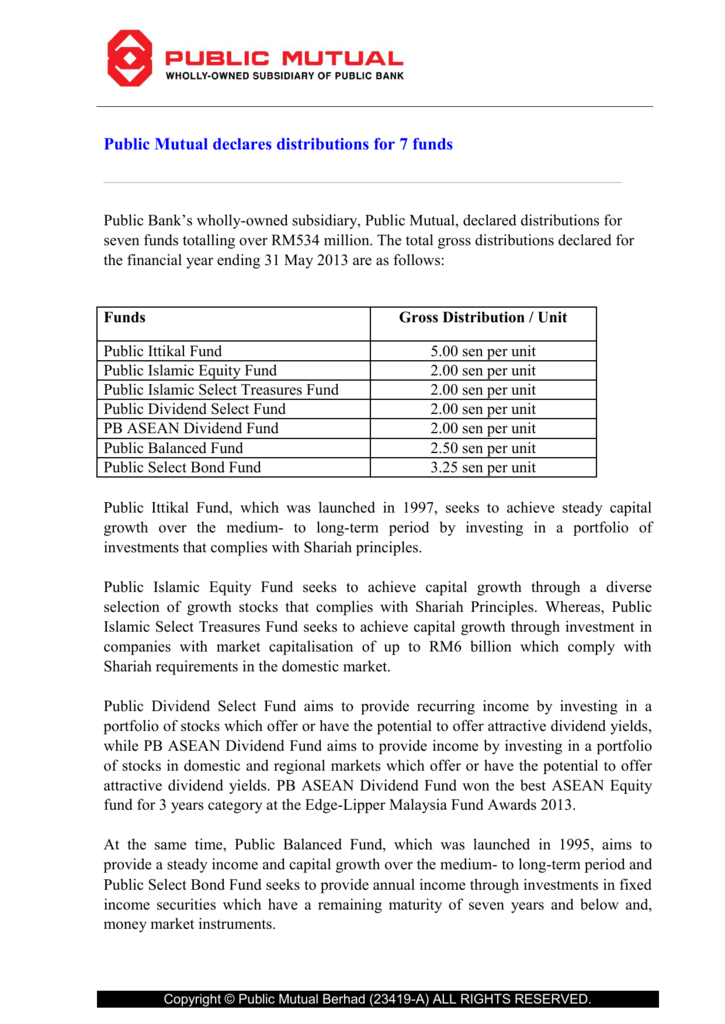

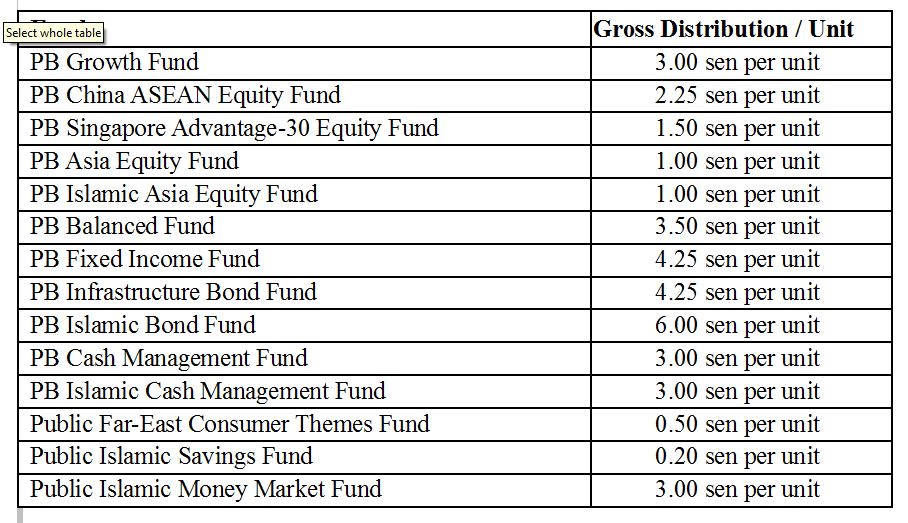

Pb series of funds that promotes various categories of funds namely equity fund mixed assets fund balanced fund bond fixed income fund and money market fund in order to cater for your various investment strategies and risk tolerance levels. A bond mutual fund can gain or lose value because the fund manager s often sell the underlying bonds in the fund prior to maturity. Kuala lumpur sept 30 public mutual bhd a wholly owned subsidiary of public bank has declared more than rm119 million distributions for 11 funds for the financial year ending september 30 2020.

The fund s objective is to provide annual income through. Our products unit trust. Public bank distributes a wide range of unit trust funds i e.

Kuala lumpur july 30 public mutual a wholly owned subsidiary of public bank has declared more than rm202 million distributions for 10 funds for the financial year ended july 31 2020. Give us a call at 603 2022 5000. For many investors a bond fund is a more efficient way of investing in bonds than buying individual securities.

In a statement today it said leading the gross distribution are public islamic income fund at 4 60 sen.