Rental Income Tax Exemption Malaysia 2020

The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing.

Rental income tax exemption malaysia 2020. Check eligibility for tax treaty exemption for personal services rendered by employees. They are as follows. The gobear complete guide to lhdn income tax reliefs.

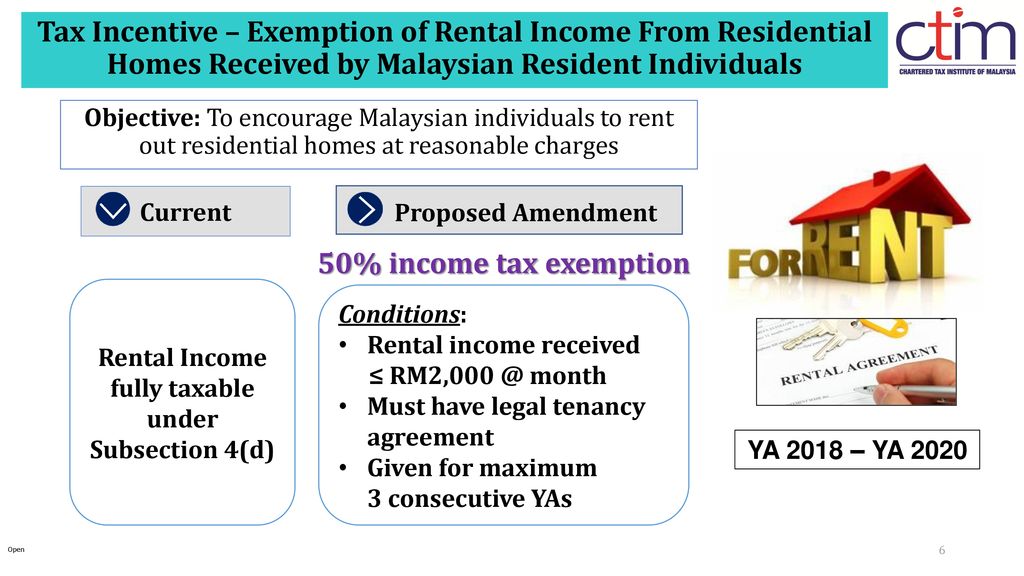

How is this special deduction given. During the tabling of budget 2018 it was stated that there ll be an exemption of 50 on the statutory income of rental received by malaysian citizens who live in malaysia. In budget 2018 the government introduced a new limited time tax exemption designed to control home rental prices.

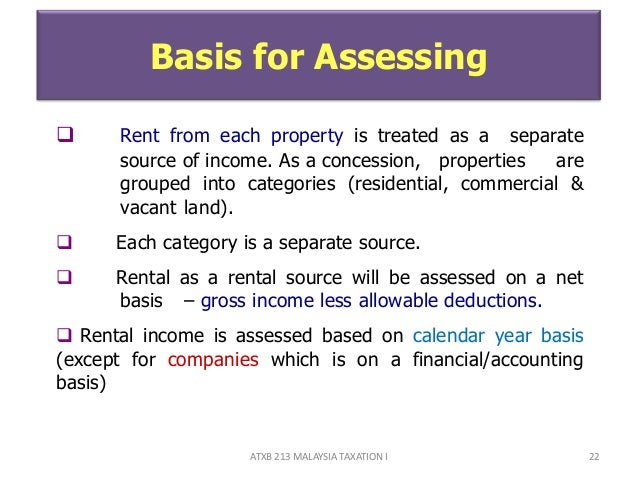

Parenthood tax rebate eligibility tool. I the landlord is an individual citizen who resides in malaysia and is the registered proprietor of his residential property. Compute rental income for tax resident and non resident individuals.

Income tax calculator for tax resident individuals. Now there are certain requirements which need to be met first before you can be qualified for this income tax exemption. Now in 2019 the time has come for property owners to begin claiming that exemption on their income tax forms.

Ringgitplus malaysia personal income tax guide 2020. Loanstreet my 9 things to know when doing 2019 income tax e filing. 1 january 2018 to 31 december 2020.

World of buzz 21 tax reliefs malaysians can get their money back for this 2019. The idea is that income from the renting of residential properties would receive a 50 exemption from income tax. Income tax exemptions of up to rm1 000 for local travel expenses will also be extended until the end of 2020.

Tax exemption on rental income from residential houses to encourage malaysian resident individuals to rent out residential homes at reasonable charges malaysia budget 2018 announced that 50 income tax exemption be given on rental income received by malaysian resident individuals from year of assessment 2018 until year of assessment 2020 subject to the following conditions. Comparehero 7 tax exemptions in malaysia to know about. Full exemption of tourism tax from july 1 2020 until june 30 2021.

Real property gains tax rpgt exemption for malaysians for disposal of up to three properties from june 1 2020 to december 31 2021. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. Capital allowance for information and communication.

To encourage the issuance of green sri sukuk in malaysia it is proposed that income tax exemption be given to each recipient of th green sri e. This special deduction will be provided through the issuance of income tax rules. Ya 2020 xls 96kb new.

When is the rental deduction period eligible for this special deduction.