Rental Income Tax Malaysia 2017

This relief is applicable for year assessment 2013 and 2015 only.

Rental income tax malaysia 2017. 19 december 2018 from the letting of the real property is charged to tax as rental income under paragraph 4 d of the ita. 6 2017 date of publication. Tax relief on resident individual income up to rm6 000 for net savings in the national education savings scheme sspn is eligible to be claimed annually effective from year of assessment 2012 until year of assessment 2017.

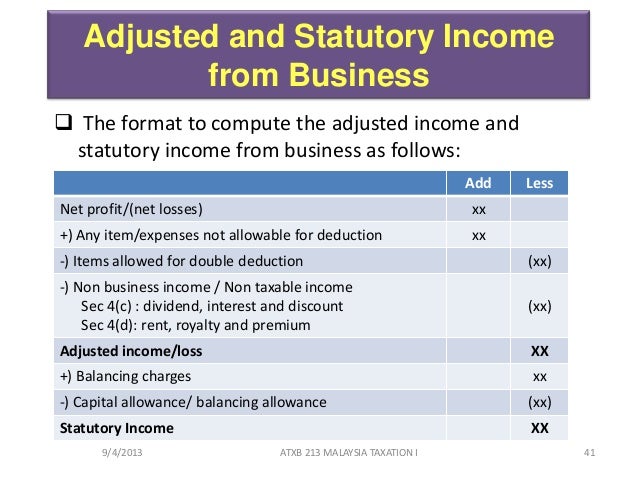

Inland revenue board of malaysia tax on income of a non resident public entertainer public ruling no. Income attributable to a labuan. This means that any profit or net amount left once you have added together your rental income and deducted any allowable expenses is taxable.

Your property is still subject to property tax which can be calculated by multiplying the annual value av of the property to the applicable property tax rate. For ya 2017 and ya 2018 and 4 on the standard tax rate for a portion of their income if there is an increase of 5 or more in the company s chargeable income compared to the immediately preceding ya. Rental income is subject to income tax.

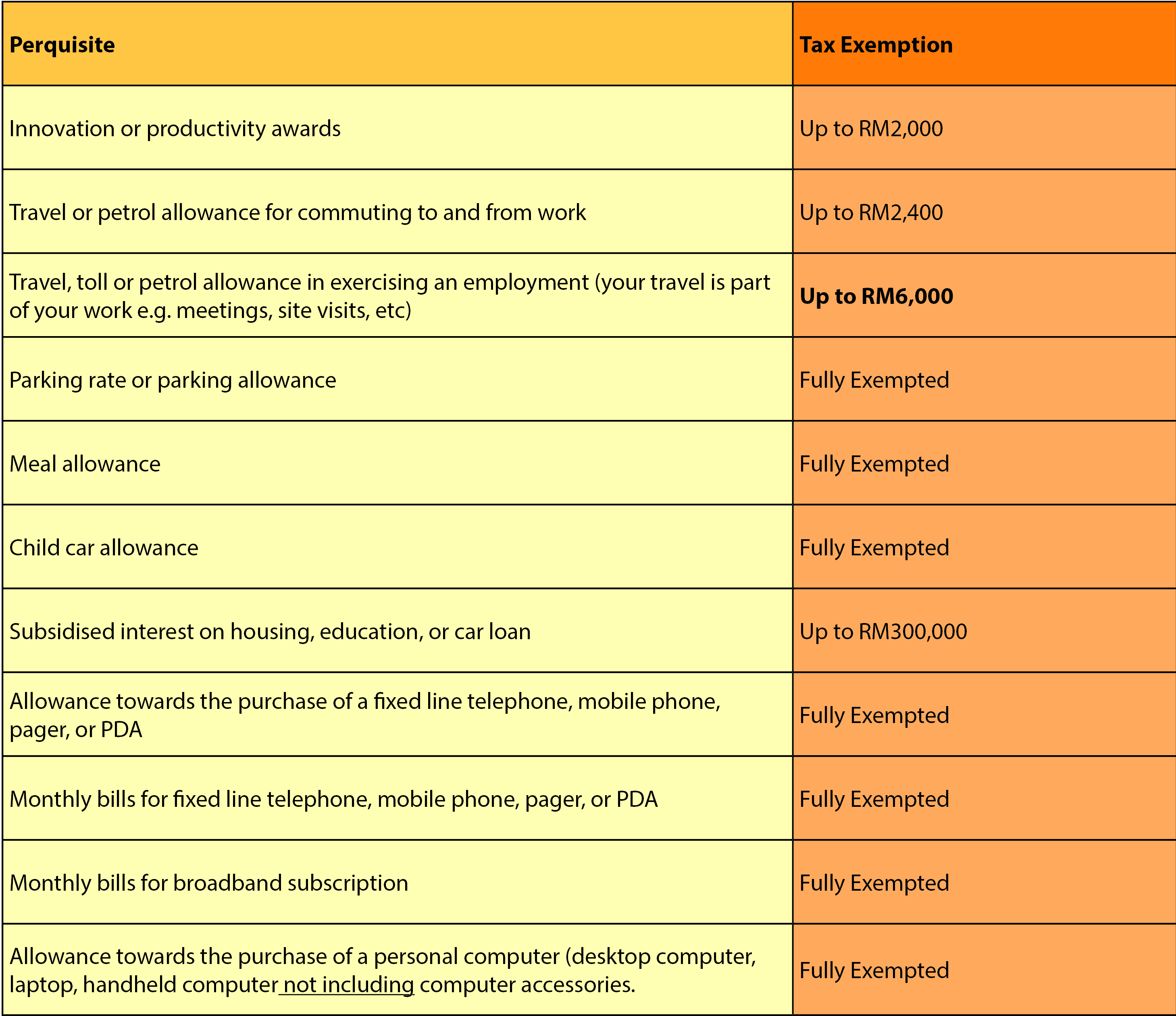

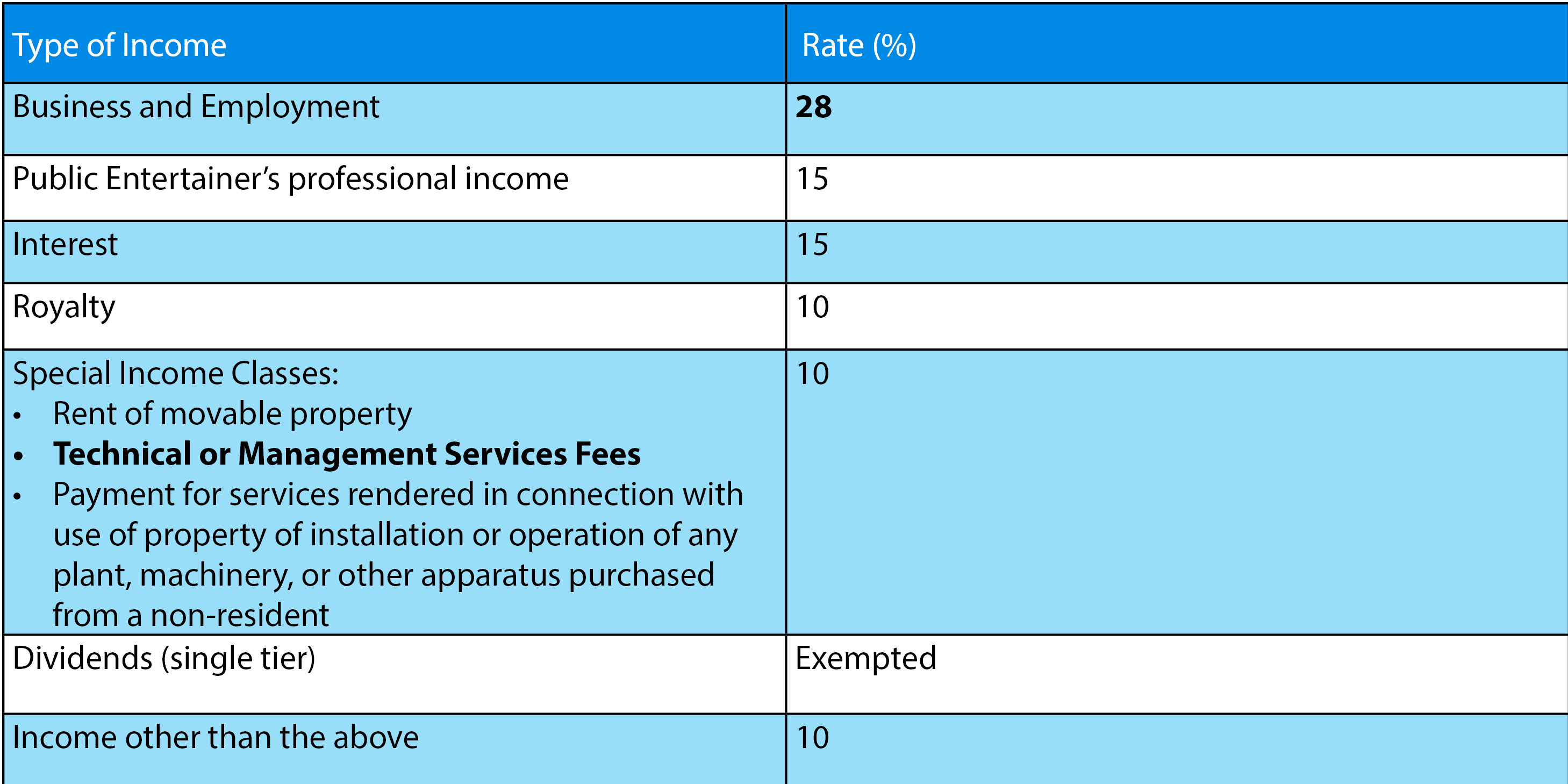

12 october 2017 director general s public ruling section 138a of the income tax act 1967 ita provides that the director general. Technical or management service fees are only liable to tax if the services are rendered in malaysia. If you re a foreign resident which means you ve been there for more than 182 days in the year you pay between 0 and 28 tax on rental income.

The reduction in the tax rate will apply to the portion of chargeable income representing the increase. Special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. While the 28 tax rate for non residents is a 3 increase from the previous year s 25.

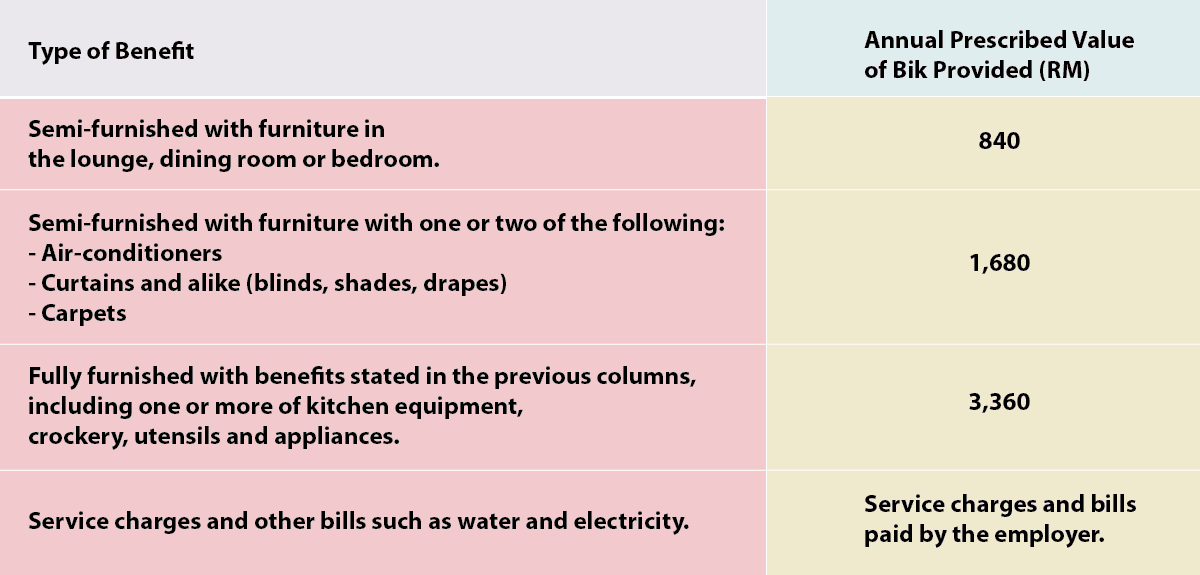

The tenants are entitled to use the swimming pool tennis court and other facilities. Inland revenue board of malaysia date of publication. As an initiative to increase home ownership for the nation the prime minister in the budget 2018 has allocated rm2 2 billion to the housing development in malaysia.

If you re not a resident and not malaysian you pay a flat rate of 28. No guide to income tax will be complete without a list of tax reliefs. What comes as a surprise to many is the 50 tax exemption on rental income received by malaysian resident individuals.