Rental Income Tax Malaysia 2019

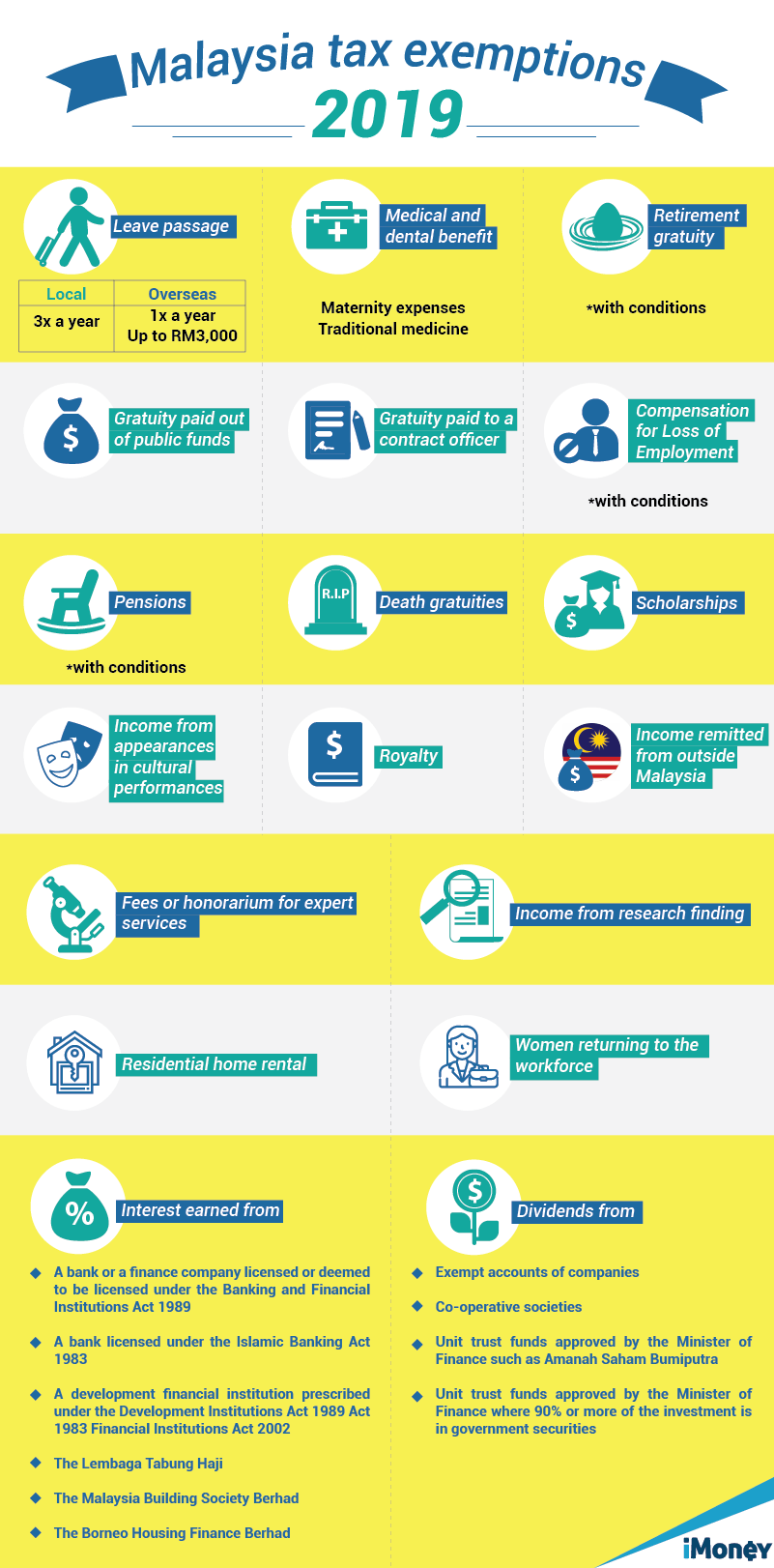

Rental income exempted from income tax malaysia and other tax reliefs for ya 2019.

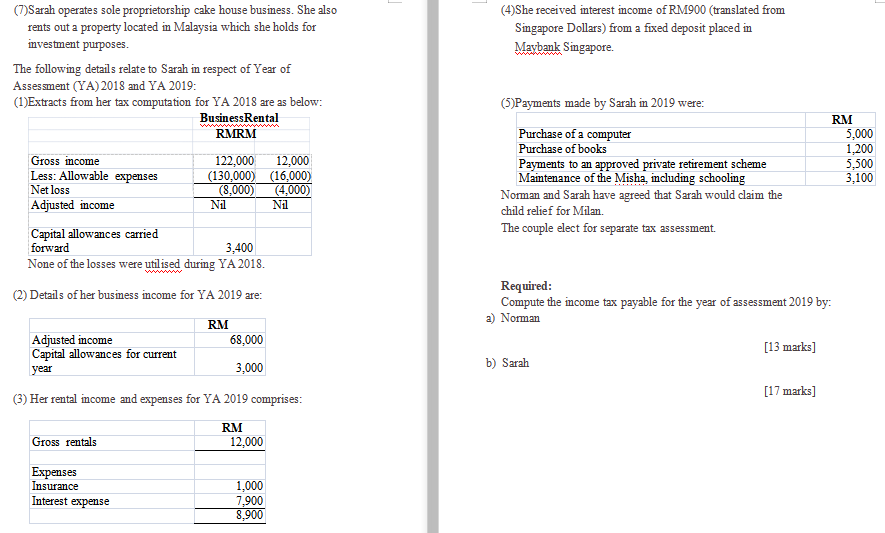

Rental income tax malaysia 2019. Individuals who own property situated in malaysia and receive rental income in return are subject to income tax. Income tax in malaysia is imposed on income accruing in or derived from malaysia except. Rental income was due in 2019 but was only paid in 2020.

08 march 2019 8 mins read to find out if your rental income can be exempted from income tax first you d need to know how it s calculated. This article first appeared in. This was introduced in section 4 d of the income tax act 1967 ita.

Tax exemption on rental income from residential houses to encourage malaysian resident individuals to rent out residential homes at reasonable charges malaysia budget 2018 announced that 50 income tax exemption be given on rental income received by malaysian resident individuals from year of assessment 2018 until year of assessment 2020 subject to the following conditions. Eo2 19 exempts a landlord who rents out his residential property from payment of income tax in respect of 50 of his statutory income derived from the rental of the residential property for the year of assessment 2018 subject to the following conditions being fulfilled. Rental income is subject to income tax.

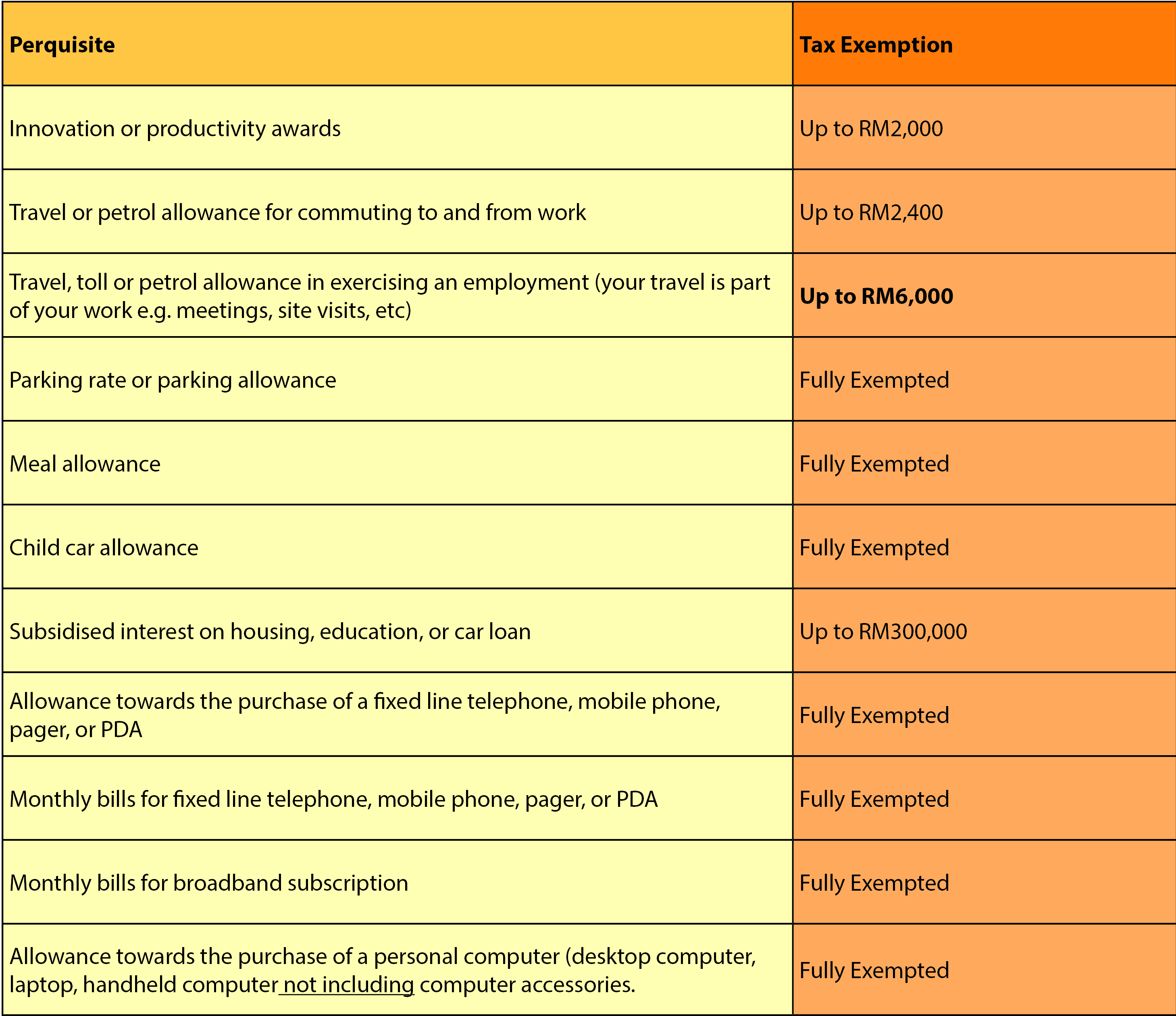

Income rm ya 2018 2019 tax rm on excess 5 000 0 1 20 000 150 3 35 000 600 8 50 000 1 800 14 70 000 4 600 21. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Deloitte malaysia inland revenue board of malaysia takeaways.

Special classes of income. Exemption of rental income from residential property 3. Such rental income is explained under section 4 d.

Your tenant rented your property from oct to dec 2019. Income tax exemption no 2 order 2019 p u. Now in 2019 the time has come for property owners to begin claiming that exemption on their income tax forms.

Tax espresso march 2019 2 greetings from deloitte malaysia tax services quick links. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. 2 order 2019 eo2 19 was gazetted on 27 february 2019.

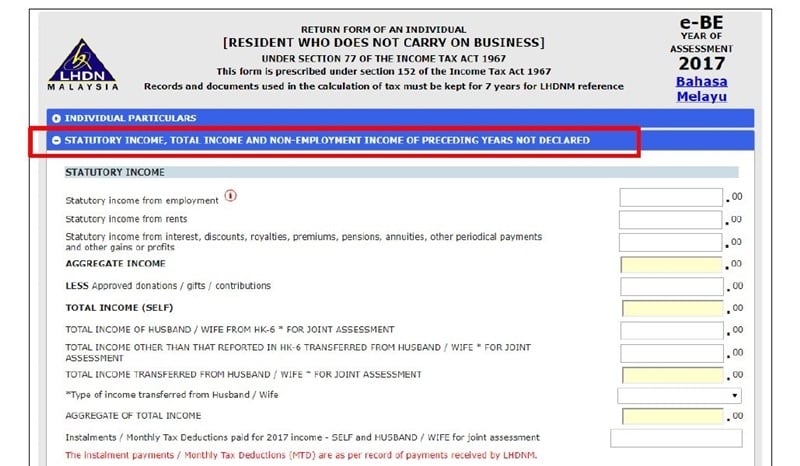

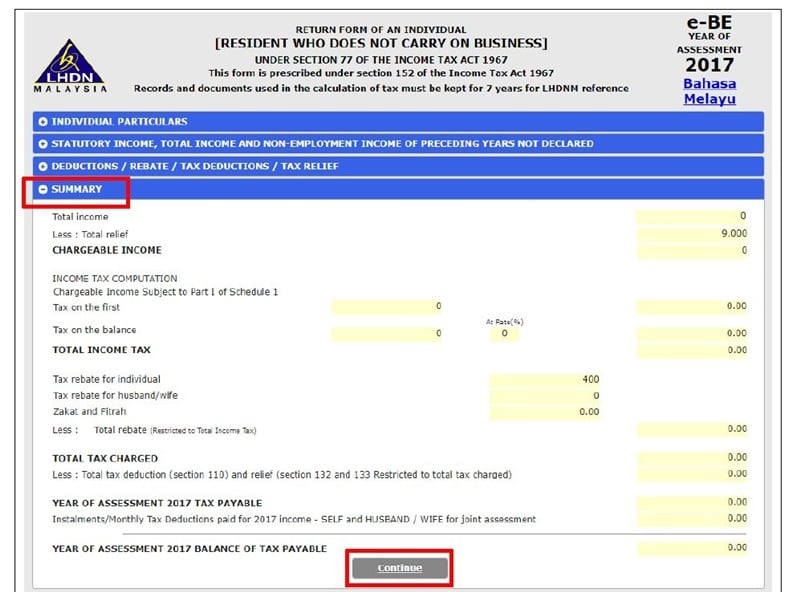

A 55 2019 please refer to the picture below for a sample on how to calculate rental income tax exemption. The idea is that income from the renting of residential properties would receive a 50 exemption from income tax. This means that any profit or net amount left once you have added together your rental income and deducted any allowable expenses is taxable.