Rental Income Tax Malaysia Calculator

Rental income is.

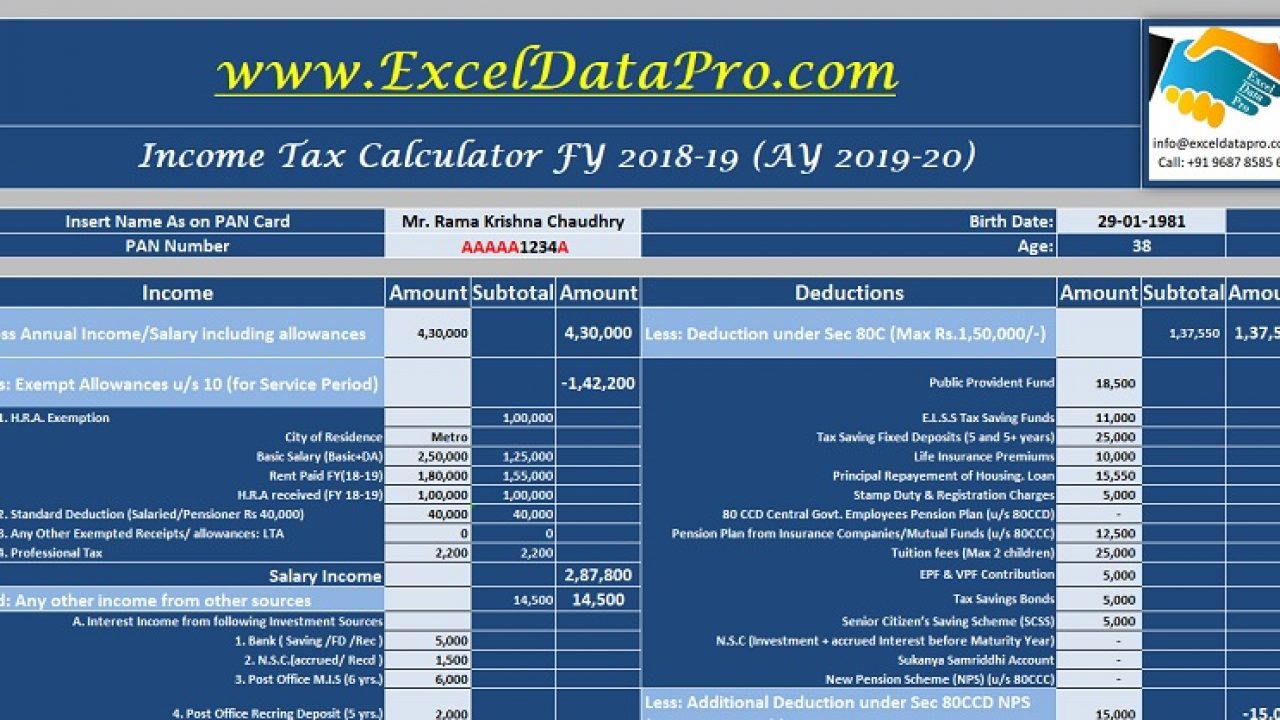

Rental income tax malaysia calculator. Your property is still subject to property tax which can be calculated by multiplying the annual value av of the property to the applicable property tax rate. For simplicity just remember that rental is in its own category and has its own progressive tax rate that ranges between 0 and 28. As a result your taxable rental income will be.

Rental income tax breakdown. You can claim 3 600 as rental expenses. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing.

2 400 in rental income tax. Foreigners and those not residing within malaysia are also charged a flat 28 tax on rental income. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property.

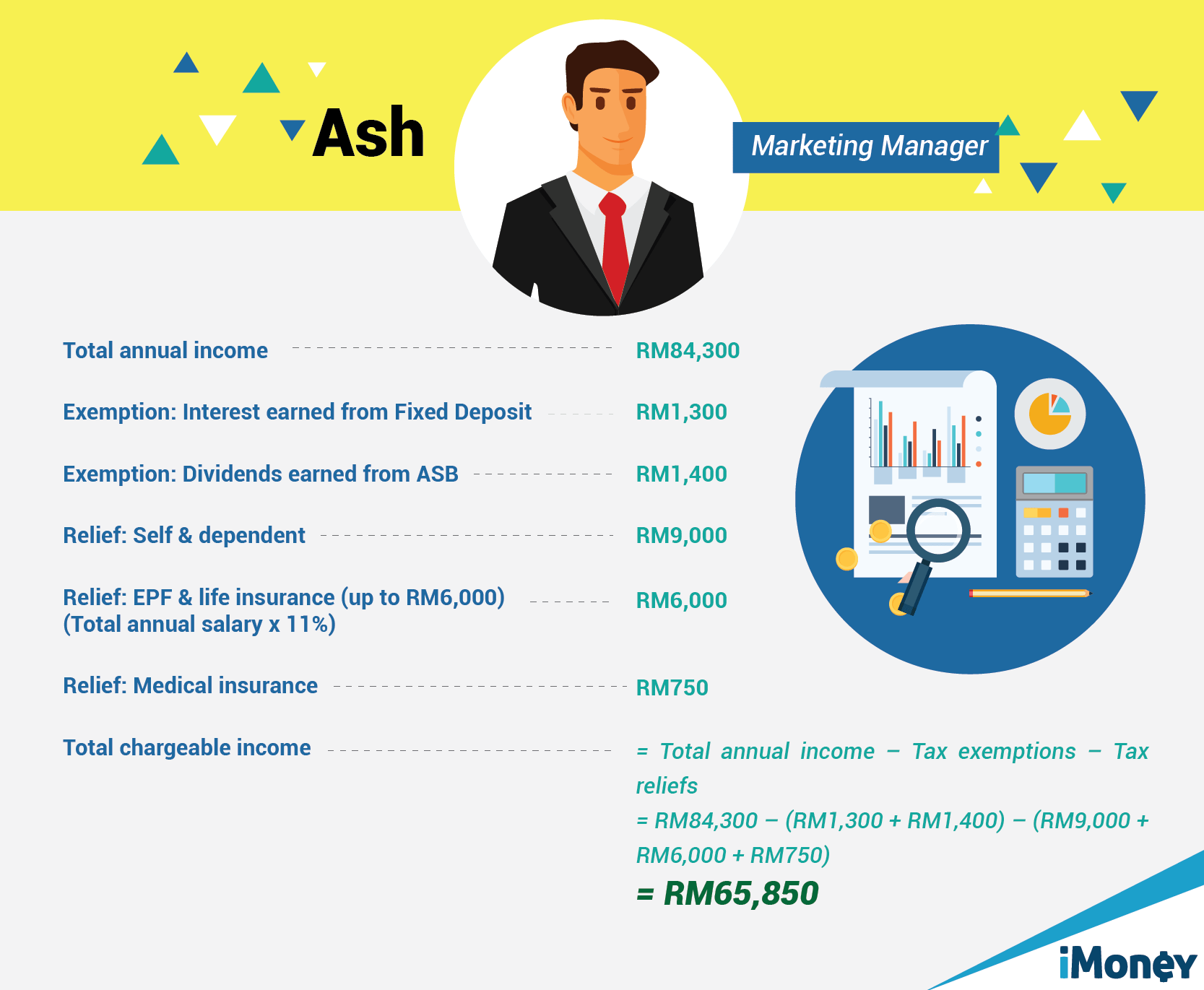

This means that any profit or net amount left once you have added together your rental income and deducted any allowable expenses is taxable. As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs and deductibles available. Free rental property calculator estimates irr capitalization rate cash flow and other financial indicators of a rental or investment property considering tax insurance fees vacancy and appreciation among other factors.

Rental income is subject to income tax. To take advantage of this there are some requirements to meet. Also explore hundreds of other calculators addressing real estate personal finance math fitness health and many more.

For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. The first 12 000 will be taxed at 20. Income received from the letting is charged to tax as rental income under paragraph 4 d of the ita.

Individuals who own property situated in malaysia and receive rental income in return are subject to income tax. The next 2 400 will be taxed at 40. Compute income tax liability for tax resident individuals locals and foreigners who are in singapore for 183 days or more 2.

What about the income tax exemption. According to section 45 of malaysia s income tax act 1967 all married couples in malaysia have the right to choose whether to file individual or joint taxes. Rental calculator for tax resident and non resident individuals xls 362kb compute rental income for tax resident and non resident individuals.

Your rental earnings are 18 000. In malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d rental income of the income tax act 1967. Such rental income is explained under section 4 d of the act.

960 in rental income tax.