Rental Income Tax Malaysia

Inland revenue board of malaysia date of publication.

Rental income tax malaysia. Individuals who own a property in malaysia that isn t used for business purposes and receive a rental income are subject to income tax. Example 7 azrie owns 2 units of apartment and lets out those units to 2 tenants. What about the income tax exemption.

The letting of the office units is treated as a non business source of yes. Facts are the same as in example 3 but maintenance services and support services are provided by zura property sdn bhd. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property.

As the properties are located in malaysia the rental income from the letting of properties is regarded as malaysian derived income. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. The tenants are entitled to use the swimming pool tennis court and other facilities.

Rental income is calculated on a net basis which means the final rental earnings amount is derived after deducting the permitted incurred expenses. Individuals who own property situated in malaysia and receive rental income in return are subject to income tax. Rental income is.

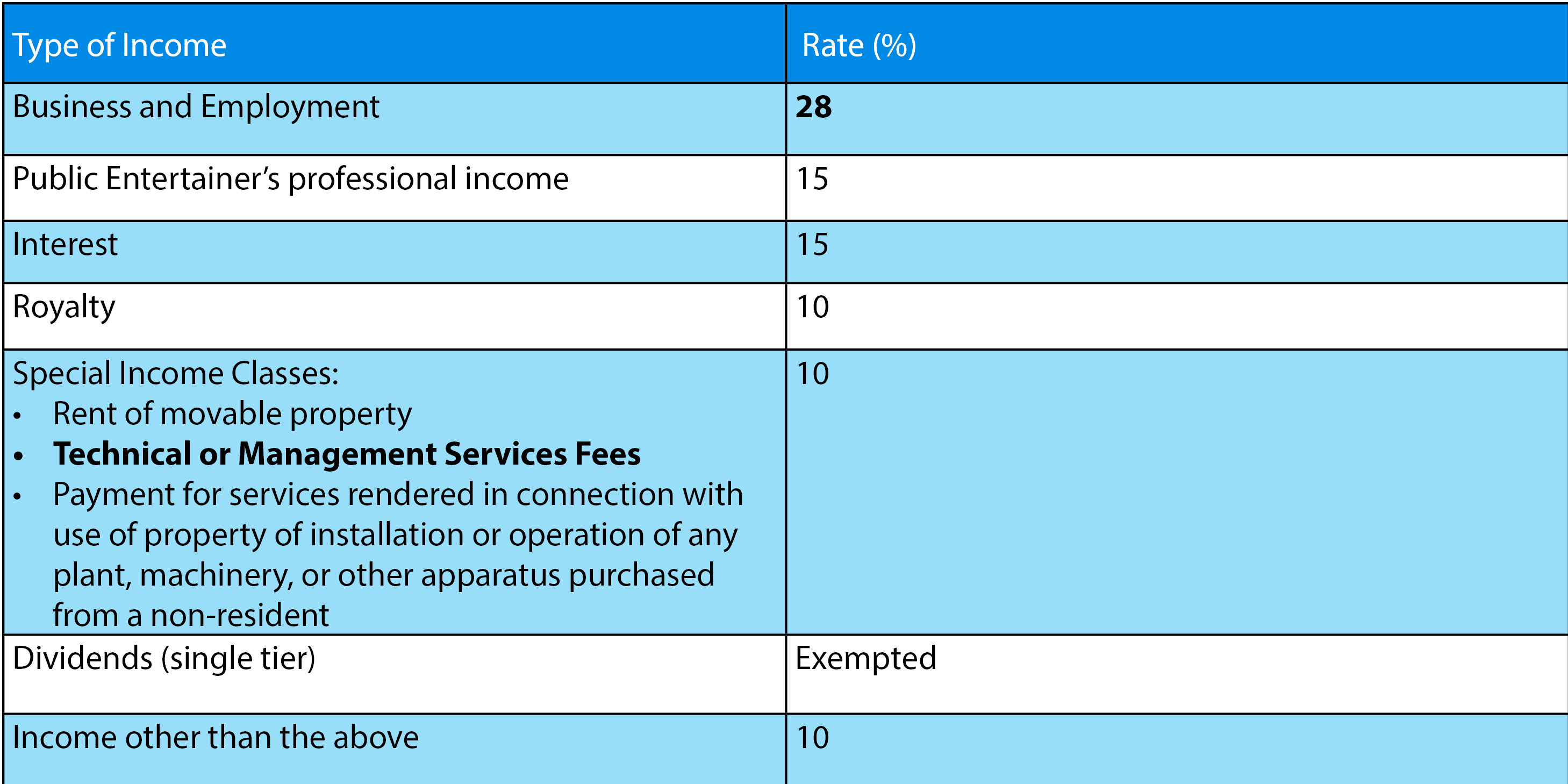

In malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d rental income of the income tax act 1967. For simplicity just remember that rental is in its own category and has its own progressive tax rate that ranges between 0 and 28. Now back to the rental income taxation situation let s make sure you know how to declare yours properly.

Income received from the letting is charged to tax as rental income under paragraph 4 d of the ita. To take advantage of this there are some requirements to meet. Therefore you are required to declare the rental income to irb by completing and submitting the relevant tax return form.

This is explained in greater detail under section 4 d of the same act. Beginning 1 january 2018 rental income received in malaysia is evaluated on a progressive tax rate which ranges from 0 to 30. This means that any profit or net amount left once you have added together your rental income and deducted any allowable expenses is taxable.

The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. Such rental income is explained under section 4 d of the act. Foreigners and those not residing within malaysia are also charged a flat 28 tax on rental income.

Your property is still subject to property tax which can be calculated by multiplying the annual value av of the property to the applicable property tax rate.