Retirement Planning In Malaysia

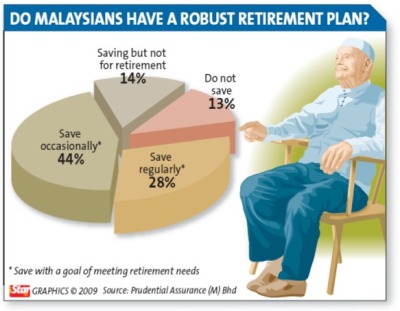

Just the thought of retirement can cause anxiety and many to feel overwhelmed.

Retirement planning in malaysia. Miscalculations in terms of your retirement fund can be caused by common misconceptions such as these. A simple table below summaries my total years to retirement. 4 inflation is an estimation.

Inflation in malaysia averages between 2 to 3 per year. I set 55 years old as my retirement age. This does not provide any analysis on your financial position investment objectives nor individual needs and must not be regarded as any advice for your financial planning.

A recent global survey showed that 88 of pre retirees in malaysia stated they are worried about not having enough. Weo world economic outlook database april 2019 updated as at april 2019. This is measured by the cpi consumer price index indicator from department of statistics of malaysia.

You can adjust the life expectancy on below slider. How many years of income do you require during retirement. This means a monthly retirement income of the only rm950 per month assuming a life expectancy of 75 years old.

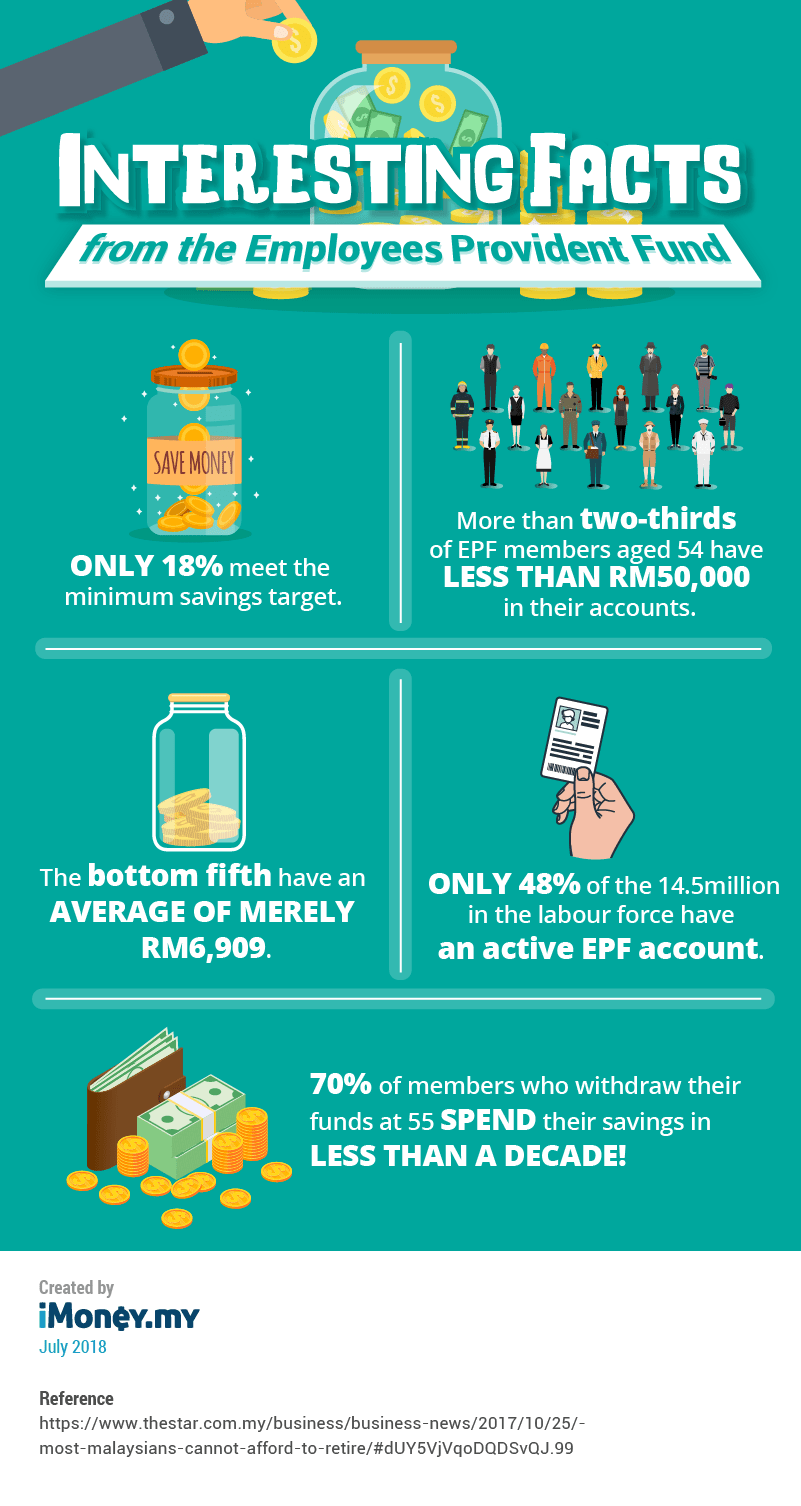

The hsbc s future of retirement a balancing act survey showed that more than two thirds of working aged people are concerned about running out of money during retirement. Last year the employees provident fund epf raised the minimum savings target to rm228 000 by the age of 55. We take 3 as conservative estimate for computation for living costs in retirement planning.

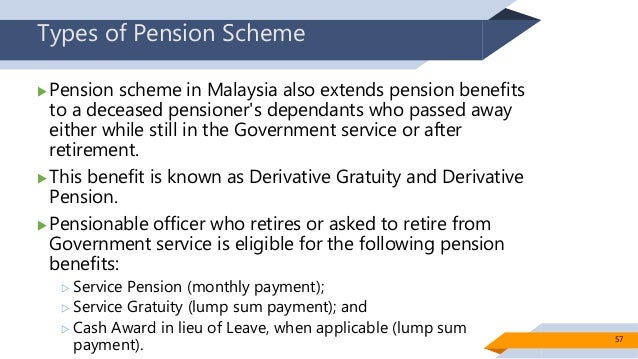

Malaysia s retirement income system is predominantly based on the epf which covers all private sector employees and non pensionable public sector employees. So if you are 45 the number of years you have before retirement is 55 45 10. Adding to that are troubling statistics released by the randstad workmonitor q1 2015 survey which show that 82 of employees in malaysia expect to retire between the ages of 60 65 well above the retirement age.

Assuming that you plan to retire at 55 simply subtract your current age by 55 and you ll get this number. Now you ll need to ascertain the number of years you have before you hit retirement age. Most companies in malaysia have this as the retirement age you can opt for.

So is your retirement fund sufficient. The financial planning is structured for hypothetical case which characteristics circumstances and requirements may differ from your own. Based on data from the malaysia department of statistics.

Under the epf. We accept no responsibility for giving any recommendation or advice based on the financial planning. From a government perspective its 60 years old.