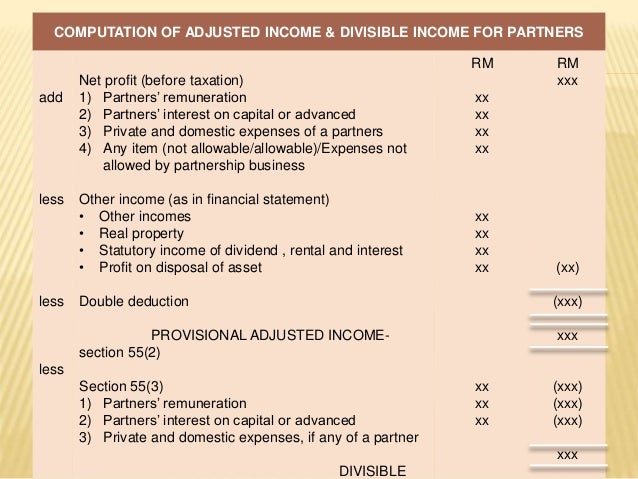

Partnership Tax Computation Format

You may obtain a pro forma tax computation to make the necessary adjustment.

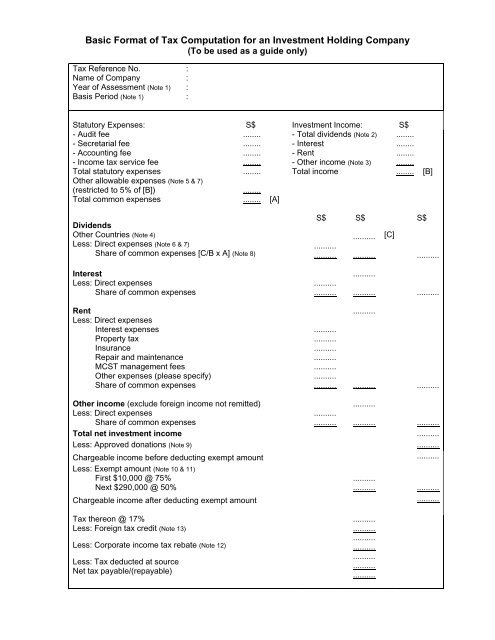

Partnership tax computation format. Due date for filling income tax return of partnership firm is 31 july. The btc is not designed for use by investment holding companies. This form may assist you to prepare the tax computation of assessable profits or adjusted loss for your business and to allocate the amount to partners.

On 18 march 2010. Cma cost accounting direct taxation laws and ethics view more. On 20 july 2020.

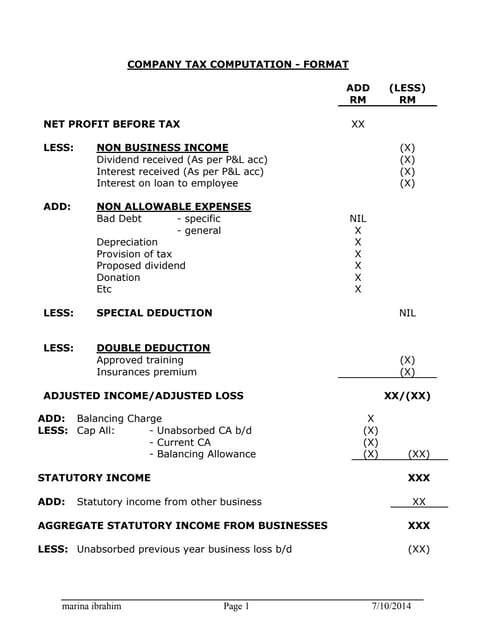

A separate computation should be prepared for each business. Excel based computation chart xlsx submitted by. Non business income x dividend received as per p l acc x interest received as per p l acc x interest on loan to employee x add.

H approved charitable donations. Part a pro forma profits tax computation. Calclulator xls submitted by.

A tax computation is a statement showing the tax adjustments to the accounting profit to arrive at the income that is chargeable to tax. But in respect of booking the expenditures following points must be kept in mind for calculation of income tax on partnership firm a deduction on account of interest to partners on capital though any amount of interest can be paid to the partners on their capital and can be booked as business expenditure but as per indian income tax act interest is allowed only at the rate of 12 per annum. Company tax computation format add less rm rm net profit before tax xx less.

Cs cost management accounting. Business law business mathematics view more. Non allowable expenses drawings cogs x holiday leave passage x bad debt specific nil general x loan to directors employees x.

In above way you can calculate income tax on partnership firm income tax return filling is mandatory for partnership firm irrespective of income. Tax adjustments include non deductible expenses non taxable receipts further deductions and capital allowances. Computation of income for an assessment year.

Investment holding companies should refer to the basic format of tax computation for an investment holding company pdf 540kb. If your business is covered under audit the due date is 30 sep. The tax schedules in the btc are those commonly used by such companies such as the renovation and refurbishment expense and capital allowance schedules.

Deduction under section 16 professional tax xxxxx entertainment allowance xxxxx. Business economics business law business mathematics view more. Income from salary salary xxxxx allowances received taxable allowances xxxxx taxable value of perquisite xxxxx gross salary xxxxx less.

Other files by the user. Other files by. Income tax computation format download preview.

Cs cost management accounting tax laws and practice. If you have more than one business make sufficient copies of the pro forma before preparing the computations. Year of assessment.

%202.png)